Money Supply Update: Scarier Than Halloween

- Anthony J. Combs

- Oct 18, 2020

- 4 min read

2020 has been a year of terror and despair for many different reasons. The worst of all might be the following charts and graphs depicting the massive interventions into the economy by the Federal Reserve. The data is unprecedented and many indicators are hitting their all-time highs or lows. The 2020 COVID interventions by the Fed make any previous interventions pale in comparison. Even the 2008 Great Financial Crisis (GFC) is barely a blip on the radar compared to the Fed's newest manipulations. Halloween is right around the corner and dressing up as any of these charts is sure to give a fright to anyone with a sound understanding of economics.

Chart #1 - TMS2 (YoY%) vs. Total Fed Assets

This chart compares the year over year change in the True Money Supply (TMS2) compared against Total Fed Assets going back to before the GFC. The 2020 monetary intervention dwarfs the interventions of 2008 and 2009. In the GFC, Fed assets double from $1T to $2T and TMS2 hit a high in the upper teens. This time Fed assets increased from roughly $4T to over $7T and TMS2 is in the upper 30s.

Chart #2 - M1 vs. M2 vs. TMS2 (YoY%)

This chart shows the year over year change in the three main money supply measures: M1, M2, and TMS2. All three are elevated since the start of 2020. Although the 2020 COVID interventions can be seen in all three metrics, it is strongest in the M1 measure. The M1 components are the most liquid of money supply components and include currency, demand deposits, and other checkable deposits.

Chart #3 - MI Components (YoY%)

This chart shows the year over year change in the components that makeup the M1 money supply measure. The year over year increase of the three M1 components: currency, demand deposits, and other checkable deposits are above the 90th percentile as compared to their historical data. Currency increased roughly 15% YoY, demand deposits increased over 50% YoY, and other checkable deposits increased over 75% YoY. M1 components sat at a combined total of just under $4T at the beginning of 2020 and now sit at roughly $5.5T in October 2020.

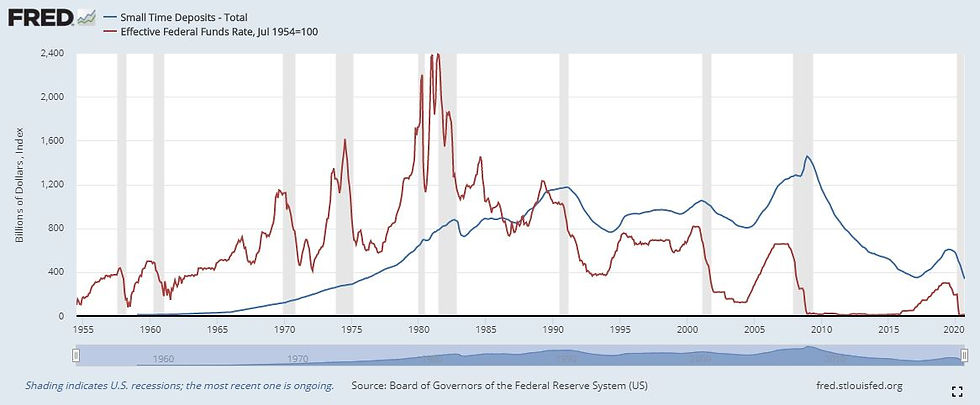

Chart #4 - M2 Components (YoY%)

This charts shows the year over year change in the components that makeup the M2 money supply measure. Retail money funds and savings at commercial banks are the main components behind the increase in M2; savings at commercial banks is the largest money supply component and currently accounts for roughly 56% of M2 measure. Savings at thrift institutions are relatively unchanged after some see-saw action in March and April. The biggest losers of the M2 metric are the small deposit time deposits (SDTD), which are down over 46% collectively. In the beginning of 2020, SDTD accounted for 3.8% of M2. In October 2020, SDTD now accounts for 1.7% of M2. Since the beginning of 2020, SDTD have decreased from $581B to $322B, roughly a 45% decrease. These SDTD accounts are hitting all-time lows for YoY percent declines.

The St. Louis Fed defines SDTD as including "...time deposits at banks and thrifts with balances less than $100,000." It is interesting that the SDTD amounts are decreasing right now. It is difficult to figure out what has happened to those funds. Have they been transferred to demand deposits or savings accounts? Does this decline represent Americans pulling money out of their certificate of deposit accounts (CDs) to cope with the recession? Declines in SDTD accounts seem to be typical during and after recessions. Although due to the low interest rate environment since the GFC, SDTD accounts were steadily on the decline. SDTD accounts seem to show a great degree of sensitivity to the Fed Funds Rate. There was a small increase in SDTD when the Fed started slowing increasing interest rates from 2016 to 2019. With the zero-interest-rate-policy (ZIRP) back into effect, SDTD will more than likely continue to decline. Why lock away your money for months and years to just receive a quarter of a percent of interest?

Chart #5 - Federal Government Deposits Held at the Federal Reserve (YoY%)

This charts shows the year over year change in the Federal Government's deposits held at the Federal Reserve. The St. Louis Fed defines this account as "...the primary operational account of the U.S. Treasury at the Federal Reserve. Virtually all U.S. government disbursements are made from this account." At one point, this measure was up over 1,000% year over year!

The Federal Government has over $1.6T sitting in this account at the Federal Reserve. The balance has never been this high in the history of the United States. This is coinciding with the largest Federal Government deficit in history of $3.1T.

Federal Government deposits held at the Fed as a percent of the TMS2 are at all-time highs. The money that the Federal Government holds now makes up almost 10% of the money supply. Historically, this measure was well below 3%.

What Does It All Mean?

The year 2020 is unprecedented in many ways. We lost Kobe. We lost and then found Kim Jong-un. COVID-19 struck and caused governments around the world to lock down large portions of their economy. The 2020 US presidential elections are a nightmare. I know I am missing about thirty other reasons why 2020 is the worst year ever, but you get the point. One of those aforementioned missing reasons why 2020 is awful is the massive and unprecedented interventions into the US and global economy by the Fed and other central banks from around the world. It is hard to focus on and care about monetary data when there is so much daily noise going on, but this is not something that should be swept under the rug.

Money and interest rates affect every aspect of our lives. Government central planning and interventions into a single industry, such as bread making, would generally only cause minor chaos and destruction constrained to that industry. But government central planning of money and the time value of money, i.e. interest rates, impacts the economy as a whole and is the main culprit of the business cycle. What happens next? What happens if there is significant inflation? Can the Fed tighten its monetary policy without crashing the economy further? Are massive Federal deficits the new normal? Will the Keynesians be replaced by the Modern Monetary Theorists? Will wealth inequality continue to grow as the Fed continues to pump up financial assets and stock markets? One thing is known for sure. Sensible fiscal and monetary policies are unlikely to return anytime soon and we should all be prepared for the consequences.

Comments